Auto Body Shop Financials: Breakeven Point and Beyond

This article is the fourth in a series on accounting. To view the rest of the series:

Part 1, click here.

Part 2, click here.

Part 3, click here.

One of the most valuable things in any collision repair business is for ownership and management to have an accurate understanding of their financial performance.

In this series, we’ve elaborated on that key point and broken down the ins and outs of the profit and loss (P&L) statement as well as given insight into industry standards on the structure of how that P&L should look. We’ve given recommendations for an easier month-end process with regards to financial statements and how to achieve a streamlined, accurate and precise product for ownership and management to help tell the financial story month over month.

Getting the P&L in the correct format with the accurate inputs — estimating, system mapping, accounting systems, expense categorizations, general ledger scrub, assignments, etc. — is the basis for this next step to understanding your shop financial performance. So, we’ve got the general ledger in order and all the processes in place to produce an easily readable P&L. Now, we’re going to focus on the importance of knowing where your shop is financially and give you a few steps you can take to increase your bottom line. It’s going to be easier than you imagined!

Making Money vs. Losing Money

Knowing your shop financials is more important now than it has ever been. Being educated on what it takes to pay for the business to operate is also crucial to the financial success of a business. Knowing your fixed costs and breakeven point up front may be the difference in making money in a month or not.

As I mentioned above, it’s very important to know what it costs to run your shop. There are expenses that occur even if you don’t repair one vehicle. Those are called “fixed” expenses. These are basically items that keep the building/facility on, or the cost of running a business. You have to pay them no matter what. Examples of fixed expenses are salaries, rent/taxes, electric, gas, phone, water, etc. These may change slightly in dollar amounts monthly, but they’ll always be there. They’re not dependent on how many cars are repaired throughout the month or impacted by the type of part you choose for a repair.

The opposite of fixed expenses are “variable” expenses. These are completely dependent on the individual jobs that are run through the shop. Your expense and profits move up and down according to the individual jobs that are running through your shop. Some examples of variable costs are:

- Labor expense for technicians working on vehicles. This is variable because it’s dependent on what you charge and then ultimately pay in labor hours for each job. For example, if you bill 10 hours on one job and then 15 on another, the labor expense for the shop changes up and down based on your repair orders.

- Parts expenses are also based on each estimate when you choose what type of part or what vendor you’re using to repair the vehicle. If you choose an OEM part from a vendor who gives a good discount, you’ll make more money than if you choose a vendor who doesn’t give a good discount. The cost and then ultimately the profit is completely dependent on the repair.

- Sublet expenses are variable as well. If you decide to sublet a part of the repair out to a vendor versus fixing it in-house, this expense/profit is impacted. When you write the estimate, the decision is made to use an outside source.

In all the above categories, it’s easy to see that the expenses move up and down throughout the month based on the mix of vehicles you get in the shop and the decisions you make when writing the estimates.

Breakeven Point

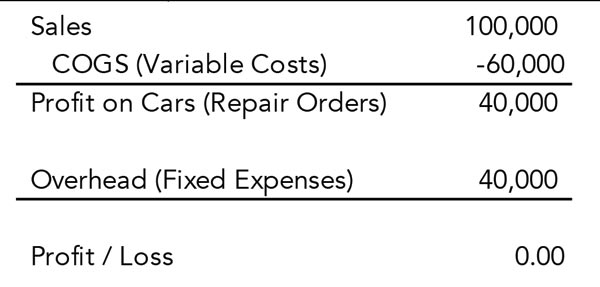

For an owner to be profitable, he or she must know the overall cost of running the business. Understanding what it takes to keep the building running helps to know your true breakeven point. The breakeven point for a business is basically:

Fixed Costs = (Revenue – Variable Costs)

So, for a body shop, you have an amount for the fixed costs (costs you have every month no matter how many vehicles you repair: rent, utilities, salaries for front-office employees, etc.). When that amount and the sales minus the costs of the repair (only those associated with the repair — labor, parts, paint and materials, sublet) match, this is considered your breakeven point.

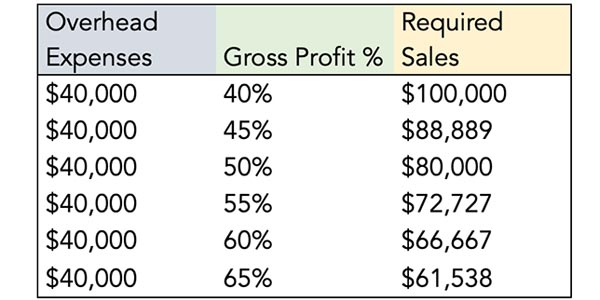

Knowing this information could help an owner understand how much in sales the business needs to pay for all the expenses of the business. Anything in sales on top of that number begins to earn you a profit. Knowing what your breakeven point is becomes much more important when inflation is rampant. The cost of parts increases, and the ever-increasing cost of labor as well as most other expenses need to be covered, which means the sales of the business need to increase as the breakeven point moves up. In the above example, this shop owner knows that the shop needs to produce $100,000 to pay all the expenses associated with the business every month.

Cost of Jobs

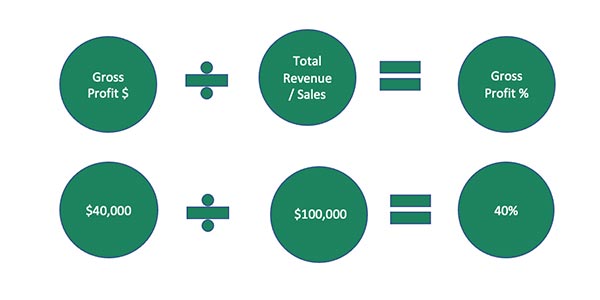

Knowing the first part of the equation is required to be able to calculate the rest. You must know the cost of the jobs you repair. You can usually find the information to get your average from your estimating system reports. You must be able to determine your gross profit percentage.

Using the above example, the results are:

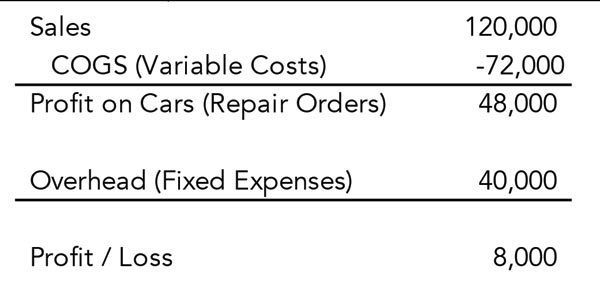

The owner or manager now knows what the average gross profit percentage is on the jobs that are produced. For example, the above gross profit percentage of this shop is 40{12dec99aef6f119e349308ab81c83b123ba77cd3d9c980ff09eaac1f958a2724}. So, if the sales of a repair order are $2,000, the profit on that job is $800. Using the numbers above, any additional car this shop repairs will give it $2,000 more in sales and $800 more in profit. If the shop completes 10 additional jobs, it’ll have $20,000 in additional sales and put $8,000 more profit in the bank. If it did this, the P&L would look like this:

Overhead

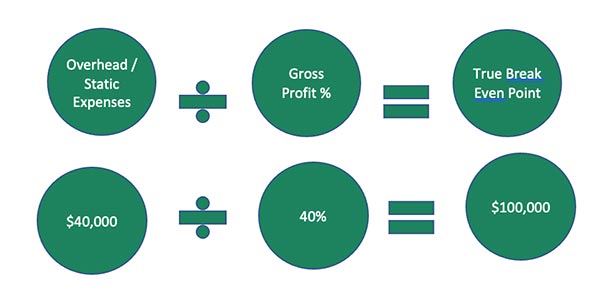

The next step is to figure out the overhead expenses. This includes rent, utilities, uniforms, vehicle expenses, training, travel, phones, etc. — anything that is not included in the cost of repairing the vehicle. Above, we see that those total $40,000. The situation above shows that the shop, at breakeven, needs to produce $100,000 in sales.

As we know, the expenses of a business change, and there are other ways to look at breakeven calculations. You could start with your fixed costs and calculate what the sales need to be:

When overhead/static expenses change, you’ll need to recalculate what sales you need to breakeven. Also, your sales will go up and down depending on what your gross profit percentage is. If you’re making more money (profit) on each job, you’ll need less in overall sales to cover the fixed expenses. Some examples using the same numbers as above are:

You can clearly see how knowing the breakeven point of the business is helpful and could drive increased profitability, help with such financial decisions as the purchase of equipment/tools and boost ownership’s confidence in his or her financial situation.

Once you have this information and feel comfortable that the numbers are accurate, you can start looking into how you can affect the gross profit side of the equation, assuming the overhead expenses stay constant. There is financial opportunity in every aspect of the repair, some greater than others. Focusing on the larger buckets will get you more of a return.

The most relevant issue facing the industry is the shortage of skilled body technicians which, in turn, drives costs higher. Technicians know that they can get a higher rate from an employer because there isn’t a huge pool of competition for them waiting at the door to take their spots. And, unfortunately for the body shop owner, they’re right. To get a skilled technician, you must pay for it. The flat rates are getting higher as the technician pool gets smaller — something that is going to continue to be an issue for all body shops.

There are things internally that you can do to mitigate the gaps in expense to profitability, but there’s an avenue that can be taken to increase the sales for labor as well. Most shop owners take for granted that they can go to their insurance partners and ask for an increase in labor rates. Many times, we’ve found with clients we’re working with that management is under the impression that their insurance companies just increase the rates whenever they decide to and there isn’t anything that can be done on the body shop side. However, an owner can proactively request labor rate increases based on inflationary activity. We can help guide you through that process.